The most common complaints from entrepreneurs concerned the complicated rules for determining the basis for health insurance premiums (business income for health premium purposes is determined differently than for tax purposes). Also problematic was the inability to take into account the loss incurred for those who had no income for fortuitous reasons. Entrepreneurs with higher earning capacity pointed out that there was no upper limit on the health contribution base. In addition, it was pointed out that the health contribution actually increases the tax base on which the tax is calculated and at the same time becomes a quasi-tax.

As a result, the new rules for calculating the health premium in many cases resulted in entrepreneurs paying an undue, inflated premium.

Health premium calculation rules should be simplified

The need to simplify the new solutions in this area was pointed out by both the previous health minister and the current government - in the coalition agreement and the plan for the first 100 days of government. Experts, too, point to the need for urgent legislative changes.

When will the tax system be reformed?

Marcin Wiącek asked Health Minister Izabela Leszczyna and Finance Minister Andrzej Domanski for detailed information on the results of analyses conducted in both ministries on the issue. And he also asked for specific proposals for reforming the rules for settling health premiums, as well as an indication of when the socially expected changes in this area are scheduled to be implemented, along with providing the anticipated timetable for legislative work.

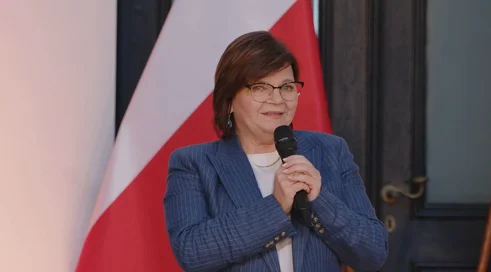

There is a response from Minister Izabela Leszczyna

The Ministry of Health is currently drafting a bill to amend the normative acts, aiming to achieve the following results:

- For persons settling on a general basis using the tax scale referred to in Article 27 of the Personal Income Tax Act of July 26, 1991 (Journal of Laws of 2024, item 266, as amended; hereinafter the "PIT Act"), and those referred to in Art. 30ca of that Law - who receive qualified income from qualified intellectual property rights - the proposed amendments provide for...

Content locked

To gain access to the complete English section of the Medexpress.pl, kindly reach out to us at [email protected].

If you already have an account, please log in